As a small developing state, our people must embrace the accomplishments we have made thus far, while recognizing our limitations in this global environment. It is against this background that we continue to strengthen the institutions that have contributed to our development.

Before Independence, we depended on Britain for our survival. We were provided with grants, concessionary loans and preferential treatment for our Agricultural Industry which contributed to our daily existence. As an independent State we now have to manage our own internal affairs.

Since our Independence, successive Governments have made tremendous strides in putting the necessary framework and policies in place that have propelled the development agenda of St. Vincent and the Grenadines over the past twenty seven years. However, present Governments are now faced with more complex and challenging problems, and as such policies to strengthen government finances are of utmost importance. Our small size does not exonerate us from the harsh realities of globalization and trade liberalization. Therefore, it is critical that we see ourselves as the makers and framers of our own destiny.

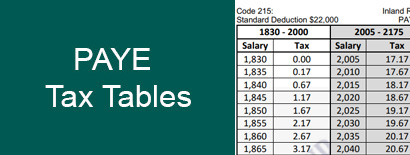

For the fiscal year 2005, taxes (direct and indirect) accounted for approximately 86% of central Government’s revenue. This helped to finance government projects, such as the building of roads, improvements to educational facilities to create a healthy learning environment for our children, improvements to the medical services, payment of wages and other social development, to name a few.

There are two types of taxes in St. Vincent and the Grenadines: direct tax, which includes income and property tax, and indirect tax which includes consumption tax, telecommunication surcharge, hotel accommodation, travel and entertainment tax. Studies on the indirect tax system reflected inefficiencies due to high cost of conducting business, cascading and difficulties in administering and compliance with the indirect tax system.

As we move forward into the international arena, St. Vincent and the Grenadines must do things as part of a regional body and as such join with our Caricom brothers and sisters to improve our taxation systems. To this end on May 1st 2007 St. Vincent and the Grenadines would replace some of the inefficient taxes with a modern Value Added Tax (VAT). This would foster further economic growth and development, and will enable our island to progress and be more competitive within a modernized Caribbean region.

For the past 27 years taxpayers have contributed significantly to the growth and development of our island and we should continue on this path. It is important that as a nation we continue to exhibit patriotism, loyalty and pride in this land of ours. This means that as taxpayers we ought to contribute our fair share of taxation to the revenue system in order to build our nation for the next generation.

We must strive to become more devoted and dedicated citizens, and get the small things right. Don’t relax; continue to put preparations in place. Read the VAT regulations. Seek information about VAT from the VAT Unit, get familiar with the necessary VAT documents and be VAT ready for May 1st 2007. Happy 27th Anniversary of Independence to St.Vincent and the Grenadines. As Calypsonian Skates said Independence is a milestone in our march for prosperity”. And remember, we must pay our taxes to improve and build our nation.