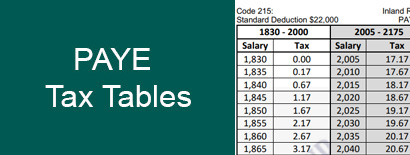

P.A.Y.E. DO’S

1. Determine monthly/weekly income and include all benefits.

2. Use code 135 M for standard deduction of $14,000.00.

3. Match salary and PAYE to get the correct deduction.

4. Remit on TD3 the total amounts deduction from employee on or before the 15th day of the following month.

5. All cheques should be made payable to The Accountant General.

6. At the end of the year, please submit TD5 or a TD4 for each employee.

7. TD5’s and TD4’s must be accompanied by a TD6.

8. When preparing TD5’s and TD4’s only include the information that is relevant to the current year.

9. All information provided should be legible.

10. Please enter the date that each employee commenced work.

P.A.Y.E. DON’TS

1. Do not exclude benefits e.g. bonus, Travelling, commissions, Housing Allowance etc.

2. Do not forget to encourage your staff to alert you if they change their filing status.

3. Do not submit a TD5 and a TD4 for the same persons who were re-employed during the same year.

4. Do not submit your payments late.It attracts interest at a rate of 1.5% per month or part thereof.

5. Do not make cheques payable to the Comptroller of Inland Revenue.

7. Do not exclude employees who have earned less than $14,000.

8. Do not include any amounts paid as personal arrears (for previous years) on TD5/4s submitted.

9. Do not forget to use the rubber stamp or enter the work place address on TD5/4’s submitted.

10. Do not forget to enter the date of leaving and private address for former employees for which TD4’s have been submitted.